I have spent most of my life in the Triad, and have become familiar with the three large cities that give it that name, as well as the many other niche communities. I grew up in Lexington, NC, and now commute regularly between Greensboro and Winston-Salem for work. So, when I had the opportunity to sit with my District 4 city council representative Nancy Hoffmann at Scuppernong Books, I was pleased that she was interested in my experiences with and impressions of both cities.

Background

In order to understand some of the current differences between the two cities, I will provide a little bit of historical context. I apologize in advance to scholars and lifelong residents of both cities!

Winston-Salem

The city was founded in 1913 as the result of the merger between the towns of "Winston" and "Salem". The town of Salem was a Moravian settlement and one of the oldest communities in the Piedmont (going back to before the Revolution). The area has retained its distinct identity with the popular historical attraction of Old Salem and Salem Women's College. Until the turn of the 20th century, Tobacco had the largest footprint in its economy. One of the features of its downtown skyline is the old RJ Reynolds tobacco headquarters and factory.

The city has a population near 250k, of which a majority are White, but there is also a large (nearly 40%) African-American minority. It also has a council-manager form of government similar to Greensboro's (see my previous post). Today some of its notable features are that it is the headquarters of Hanesbrands and BB&T, continues to have a thriving arts culture with the NC School of the Arts, and is home to the private University of Wake Forest.

Greensboro

Founded in 1808, Greensboro as a City is older than Winston-Salem, but in terms of settled communities it is actually slightly younger. Similar to the Moravian history of Salem, Greensboro's New Garden area has a history as a Quaker settlement, of which Guilford College is an example of that legacy. In terms of industry, Greensboro had a larger concentration of Textiles, with firms such as Cone Mills and Burlington Industries playing a large role in its economic development.

Greensboro is a slightly larger city than Winston-Salem, with a population near 300k, and is also majority White with a large African-American minority. I have discussed some of the distinctive features of Greensboro in my previous post.

Modern Comparison

As someone who lives in Greensboro and works in Winston-Salem, I have noticed some of the differences, pros, and cons, of both areas.

Road Systems

Anyone who commutes between Greensboro and Winston-Salem can opine on the differences in the quality of the road systems in certain areas.

Conclusion

Background

In order to understand some of the current differences between the two cities, I will provide a little bit of historical context. I apologize in advance to scholars and lifelong residents of both cities!

Winston-Salem

The city was founded in 1913 as the result of the merger between the towns of "Winston" and "Salem". The town of Salem was a Moravian settlement and one of the oldest communities in the Piedmont (going back to before the Revolution). The area has retained its distinct identity with the popular historical attraction of Old Salem and Salem Women's College. Until the turn of the 20th century, Tobacco had the largest footprint in its economy. One of the features of its downtown skyline is the old RJ Reynolds tobacco headquarters and factory.

The city has a population near 250k, of which a majority are White, but there is also a large (nearly 40%) African-American minority. It also has a council-manager form of government similar to Greensboro's (see my previous post). Today some of its notable features are that it is the headquarters of Hanesbrands and BB&T, continues to have a thriving arts culture with the NC School of the Arts, and is home to the private University of Wake Forest.

Greensboro

Founded in 1808, Greensboro as a City is older than Winston-Salem, but in terms of settled communities it is actually slightly younger. Similar to the Moravian history of Salem, Greensboro's New Garden area has a history as a Quaker settlement, of which Guilford College is an example of that legacy. In terms of industry, Greensboro had a larger concentration of Textiles, with firms such as Cone Mills and Burlington Industries playing a large role in its economic development.

Greensboro is a slightly larger city than Winston-Salem, with a population near 300k, and is also majority White with a large African-American minority. I have discussed some of the distinctive features of Greensboro in my previous post.

Modern Comparison

As someone who lives in Greensboro and works in Winston-Salem, I have noticed some of the differences, pros, and cons, of both areas.

Road Systems

Anyone who commutes between Greensboro and Winston-Salem can opine on the differences in the quality of the road systems in certain areas.

- Winston-Salem

- Highway 52 intersects both Business and Interstate 40 fairly close to downtown Winston-Salem.

- The area where 52 intersects Business 40 is a known problem spot, and has been under continued construction for nearly a decade.

- Winston has no urban loop, like what one finds in Charlotte or Raleigh, which may less necessary due to its smaller size.

- Winston has been experimenting with traffic circles in order to ease congestion in certain areas.

- Aside from Business 40, Stratford Road and Hanes Mall Boulevard are also hot areas for shopping and dining, but the traffic system has not kept pace with their development, and accidents as well as volume contribute to significant delays.

- Bonds passed in 2014 combined with DOT funding should continue to allow the city to improve its traffic situation.

- Greensboro

- Highway 40 passes under Wendover and Gate City Boulevard with relative ease, although there is some congestion in the northern party of the city where it meets with I-85.

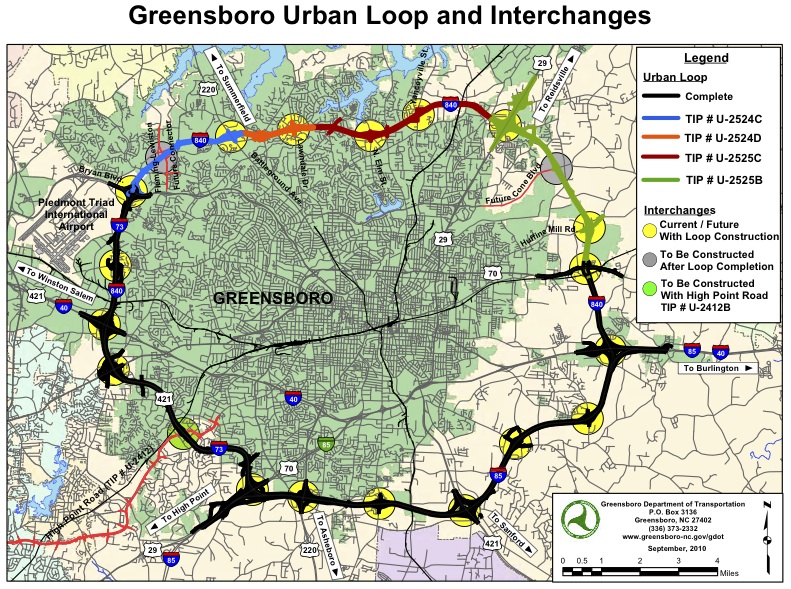

- Greensboro has a partially completed urban loop, and DOT funding should allow its full completion before the end of the decade.

- Traffic congestion is possible on Wendover and Battleground Avenues, but it is normally brief and road capacities as well as stop light switching appear to be better when compared to Winston-Salem.

- There's considerable construction along Gate City Boulevard towards High Point, and at sites where the loop is being completed, but the overall congestion and delay is less than that experience in Winston-Salem around 52 and Business 40.

- The downtowns of Winston and Greensboro both have a grid system, but the grid system is much more extensive in Greensboro and seems to go much further outside of downtown.

Urban Revival

Both cities have experimented with reviving downtown life as a means of helping the whole city recover from the losses of their key industries. In these areas, both cities have shown some success while focusing on different areas.

- Winston-Salem

- Winston has several large downtown convention centers that are excellent for large corporate gatherings. On several days out of the year I've seen the downtown flooded with employees from local and out-of town companies, which is good for business.

- Craft Brewing: Downtown Winston is home to Foothills Brewery, which is a popular local restaurant and brewing company. Overall, craft brewing has helped revive the downtown bar and dining scene.

- Innovation Quarter: This area is part of the former RJ Reynolds site. The City has spent a lot of time, money, and effort on recruiting technology firms such as INMAR, along with the University of Wake Forest, to fill this site with so-called New Economy jobs. I know several people who work in this area, and it has made a considerable amount of progress. Only time will tell, but this has certainly started to turn that section of the city around.

- Downtown Living: Several developers have also spent considerable resources on refashioning older downtown buildings into upscale apartments for downtown living. As a strategy for keeping younger people interested in information-type jobs and convenient living, it seems like a necessary investment.

- Greensboro

- Greensboro lacks the large-scale convention center capacity that Winston-Salem has, at least for downtown. However, the plans for building larger Hotels may address this shortcoming in the near future.

- Greensboro has ridden the Craft Brewing wave a lot further than Winston-Salem has thus far. With Natty Green's, the Pig Pounder, Red Oak Brewing, etc. it is in a similar league with Asheville in driving the Craft Brewing boom.

- Greensboro has also experimented with using historical tax credits as a means of reviving some of its older downtown buildings for young people and new economy jobs. In terms of creating a better downtown experience, this has so far been successful.

- The revival of Revolution Mills, is a hopeful story of success in the making analogous to the Innovation Quarter in Winston-Salem.

- In terms of Parks and Recreation, the Greensboro parks and Greenway currently exceed anything like what Winston-Salem has near its downtown, and Greensboro plans to continue their expansion.

Conclusion

I enjoyed the opportunity to meet Councilwoman Hoffmann (who set me off on this comparison). For those of you in District 4, I will have you know that she answers your emails at 3am, because she apparently requires very little sleep! Overall, I'm pleased to live in Greensboro and commute to Winston-Salem (although I hope the commute to Winston will improve in the near future!). I also applaud the effort both cities have made to find a new competitive focus and to revive their downtowns. One of my concerns is that, during a period of economic expansion, it is sometimes difficult to find out what approaches and organizations are truly profitable. To the extent that the City Government subsidizes or invests heavily in a private enterprise, it may not be until the next recession that we discover that our investment (a taxpayer investment) was a poor one. Hopefully this admittedly brief analysis will help others to organize their own thoughts, and to keep the revival going through the good times and the inevitable bad times.